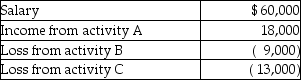

Nancy reports the following income and loss in the current year.  All three activities are passive activities with respect to Nancy.Nancy also has $21,000 of suspended losses attributable to activity C carried over from prior years.During the year,Nancy sells activity C and realizes a $15,000 taxable gain.What is Nancy's AGI as a result of these transactions?

All three activities are passive activities with respect to Nancy.Nancy also has $21,000 of suspended losses attributable to activity C carried over from prior years.During the year,Nancy sells activity C and realizes a $15,000 taxable gain.What is Nancy's AGI as a result of these transactions?

Definitions:

Surrogacy Contracts

Legal arrangements where a surrogate agrees to carry and deliver a child for another person or couple, specifying rights, obligations, and expectations of all parties involved.

Exploitative

Exploitative describes actions or conditions that take unfair advantage of others, often in a way that is unethical or unjust.

Carson Strong

A person's name, lacking context for a definition without additional information.

Human Reproductive Cloning

The creation of a genetically identical copy of a human, focusing specifically on reproducing human DNA.

Q3: Identify the oxidizing and reducing agents in

Q6: Margaret died on September 16,2016,when she owned

Q11: Place the following atoms or ions in

Q13: Silver has two stable isotopes with masses

Q26: Self-employed individuals may deduct the full self-employment

Q32: Which of the following may be used

Q63: Matt paid the following taxes this year:

Q81: One of the requirements which must be

Q95: Raul and Jenna are married and are

Q137: On July 25,2015,Marilyn gives stock with a