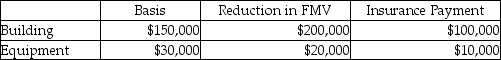

Lena owns a restaurant which was damaged by a tornado.The following assets were partially destroyed:  Lena has AGI of $50,000.What is the amount of Lena's deductible casualty loss?

Lena has AGI of $50,000.What is the amount of Lena's deductible casualty loss?

Definitions:

Disabled

This term refers to individuals who have a condition, either physical or mental, that substantially limits one or more major life activities.

Nontaxable Social Security

Social Security benefits that are not subject to federal income tax under certain income conditions.

Base Amount

A specific income threshold set by tax regulations, which may affect the calculation of deductions, credits, or taxes owed.

Credit Calculation

The process of determining the amount of credit that taxpayers are eligible to subtract directly from the taxes they owe to the government.

Q1: Under the accrual method,recurring liabilities may be

Q14: Rank F,Cl,and Br in order of increasing

Q46: What volume of Ar at 45°C and

Q47: A 10.0 L flask contains 2.5 atm

Q79: Donald sells stock with an adjusted basis

Q81: One of the requirements which must be

Q93: Lisa loans her friend,Grace,$10,000 to finance a

Q120: If the stock received as a nontaxable

Q128: Adam purchased 1,000 shares of Airco Inc.common

Q130: A taxpayer has made substantial donations of