Multiple Choice

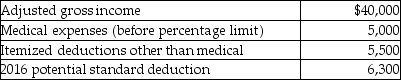

A review of the 2016 tax file of Gregory,a single taxpayer who is age 40,provides the following information regarding Gregory's 2016 tax status:  In 2017,Gregory receives a reimbursement for last year's medical expenses of $1,200.As a result,Gregory must

In 2017,Gregory receives a reimbursement for last year's medical expenses of $1,200.As a result,Gregory must

Definitions:

Related Questions

Q8: Which of the following is the largest

Q14: All of the following are examples of

Q49: Which of the following atoms contains the

Q60: Sam retired last year and will receive

Q72: Taj Corporation has started construction of a

Q73: Hope receives an $18,500 scholarship from State

Q76: If an individual is not "away from

Q100: Each year a taxpayer must include in

Q119: Taxpayers are allowed to recognize net passive

Q150: The following individuals maintained offices in their