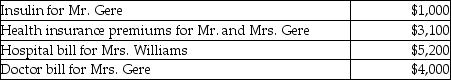

Mr.and Mrs.Gere,who are filing a joint return,have adjusted gross income of $50,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Gere's mother,Mrs.Williams.The Gere's could claim Mrs.Williams as their dependent,but she has too much gross income.  Mr.and Mrs.Gere (both age 40) received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Mr.and Mrs.Gere (both age 40) received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Definitions:

Consumer Debtors

Individuals or entities that owe money for personal, as opposed to business, expenses.

Chose In Action

The thing or benefit that is transferred in an assignment; intangible personal property, such as a claim or the right to sue.

Personal Property Security Act

Legislation that outlines the rules for creating and enforcing security interests in personal property, offering a way for creditors to secure repayment of debt.

Attachment

A legal process by which a court of law, at the request of a creditor, designates specific property owned by the debtor to be transferred to the creditor, or sold for the benefit of the creditor.

Q19: A charitable contribution in excess of the

Q27: Tina purchases a personal residence for $278,000,but

Q29: Round the answer to the following problem

Q30: What is the mass (in grams)of a

Q44: Gain on sale of a patent by

Q50: Erin's records reflect the following information: 1.Paid

Q54: Ben is a well-known professional football quarterback.His

Q59: For a nonmetal in Group 16 of

Q63: In 2014 Bonnie,a sole proprietor,loaned her employee,John,$10,000

Q85: Ahmad's employer pays $10,000 in tuition this