Phoebe's AGI for the current year is $120,000.Included in this AGI is $100,000 salary and $20,000 of interest income.In earning the investment income,Phoebe paid investment interest expense of $30,000.She also incurred the following expenditures subject to the 2% of AGI limitation:

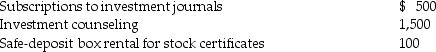

Investment expenses:

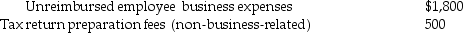

Non-investment expenses:

Non-investment expenses:

What is Phoebe's investment interest expense deduction for the year?

What is Phoebe's investment interest expense deduction for the year?

Definitions:

Q21: Convert 8.900× 10<sup>-8</sup> meters to nanometers and

Q22: Van pays the following medical expenses this

Q24: The reaction of coal and water at

Q27: CT Computer Corporation,a cash-basis taxpayer,sells service contracts

Q42: Cafeteria plans are valuable to employers because<br>A)they

Q50: Charles is a single person,age 35,with no

Q62: Donald has retired from his job as

Q69: A three-day investment conference is held in

Q80: Commuting to and from a job location

Q84: Martina,who has been employed by the Smythe