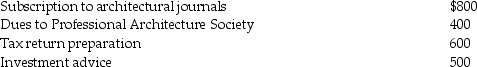

Wang,a licensed architect employed by Skye Architects,incurred the following unreimbursed expenses this year:  Wang's AGI is $75,000.What is his net deduction for miscellaneous itemized deductions?

Wang's AGI is $75,000.What is his net deduction for miscellaneous itemized deductions?

Definitions:

Flotation Costs

Financial outlays a business faces when it issues new stocks, covering charges for underwriting, legal services, and registration documentation.

Retained Earnings

The portion of a company's profits that is kept or retained within the company instead of being paid out to shareholders as dividends, often used for investment or to pay off debt.

IRR

Internal Rate of Return; a financial measurement tool utilized to assess the potential profit of investment opportunities.

WACC

Weighted Average Cost of Capital, a calculation that reflects the average rate of return a company is expected to pay to all its security holders.

Q17: Rubidium has two naturally occurring isotopes.The average

Q33: Under the wash sale rule,if all of

Q40: Tom and Heidi,husband and wife,file separate returns.Tom

Q55: An accrual-basis taxpayer receives advance payment for

Q57: Which of the following constitutes constructive receipt

Q68: Amy's employer provides her with several fringe

Q68: On August 1 of this year,Sharon,a cash

Q84: Business investigation expenses incurred by a taxpayer

Q100: Each year a taxpayer must include in

Q135: Losses incurred on wash sales of stock