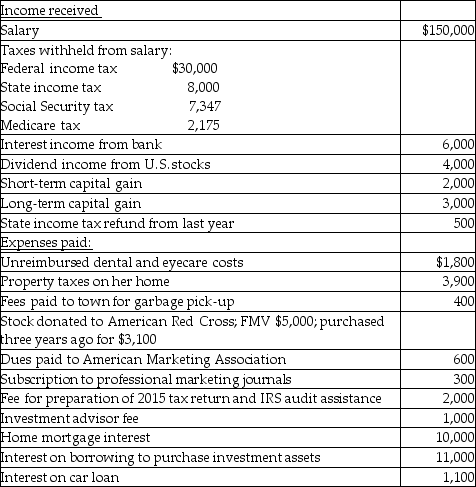

Hope is a marketing manager at a local company.Information about her 2016 income and expenses is as follows:

Compute Hope's taxable income for the year in good form.Show all supporting computations.Hope is single,and she elects to itemize her deductions each year.Assume she does not make any elections regarding the investment interest expense.Also assume that her tax profile was similar in the preceding year.

Compute Hope's taxable income for the year in good form.Show all supporting computations.Hope is single,and she elects to itemize her deductions each year.Assume she does not make any elections regarding the investment interest expense.Also assume that her tax profile was similar in the preceding year.

Definitions:

Grandchildren

The children of one's own children, representing a subsequent generation within a family that strengthens lineage continuity and familial bonds.

Primary Responsibility

The main duty or obligation one is held accountable for in a job, project, or role.

Grandparents

The parents of one's parents, often playing significant roles in family structure and child rearing.

Divorce

The legal dissolution of a marriage by a court or other competent body, ending the marital bond between two individuals.

Q12: Emma Grace acquires three machines for $80,000,which

Q20: Mae Li is beneficiary of a $70,000

Q22: Mackensie owns a condominium in the Rocky

Q42: Abby owns a condominium in the Great

Q45: During the current year,Tony purchased new car

Q46: On July 31 of the current year,Marjorie

Q78: Gwen traveled to New York City on

Q96: The key distinguishing factor for classifying a

Q110: Sam received a scholarship for room and

Q114: Gayle,a doctor with significant investments in the