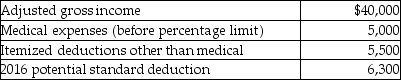

A review of the 2016 tax file of Gregory,a single taxpayer who is age 40,provides the following information regarding Gregory's 2016 tax status:  In 2017,Gregory receives a reimbursement for last year's medical expenses of $1,200.As a result,Gregory must

In 2017,Gregory receives a reimbursement for last year's medical expenses of $1,200.As a result,Gregory must

Definitions:

Diminishing Marginal Returns

A principle stating that as additional units of a variable input are added to a fixed input, the additional output from each new unit of input will eventually decrease.

Variable Factors

Elements in production that can change in the short term, such as labor and raw materials, in contrast to fixed factors like capital.

Total Cost

The complete sum of all expenses incurred in the production of goods or services, including both fixed and variable costs.

Output

the total amount of goods or services produced by a company, industry, or economy in a given period.

Q15: Atomic dimensions are often reported in Ångstroms

Q16: Which two of the following elements are

Q22: If an employee incurs travel expenditures and

Q35: If 25.00 mL of 4.50 M NaOH(aq)is

Q42: Medical expenses incurred on behalf of children

Q51: Jessica owned 200 shares of OK Corporation

Q57: Itemized deductions are deductions for AGI.

Q95: All payments made by an employer to

Q100: Before consideration of stock sales,Rex has generated

Q122: A single individual with no dependents can