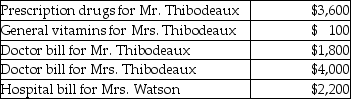

Mr.and Mrs.Thibodeaux (both age 35) ,who are filing a joint return,have adjusted gross income of $75,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Thibodeaux's mother,Mrs.Watson (age 63) .Mrs.Watson provided over one-half of her own support.  Mr.and Mrs.Thibodeaux received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Mr.and Mrs.Thibodeaux received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Definitions:

Compromise Dividend Policy

A strategy for distributing earnings to shareholders that seeks to balance between retaining earnings for reinvestment and paying dividends.

NPV Projects

Projects that are evaluated based on the Net Present Value method, which calculates the present value of future cash flows minus the initial investment cost.

Debt/Equity Ratio

The ratio that highlights the proportional use of debt and shareholders' equity in asset financing for a company.

Stripped Common Shares

Common stock on which dividends and capital gains are repackaged and sold separately.

Q11: Which three elements are likely to have

Q16: Tessa is a self-employed CPA whose 2016

Q32: Ted pays $2,100 interest on his automobile

Q33: Discuss briefly the options available for avoiding

Q37: While points paid to purchase a residence

Q45: During the current year,Paul,a single taxpayer,reported the

Q51: On July 1 of the current year,Marcia

Q90: Justin has AGI of $110,000 before considering

Q110: An expense is considered necessary if it

Q140: Educational expenses incurred by a bookkeeper for