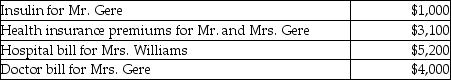

Mr.and Mrs.Gere,who are filing a joint return,have adjusted gross income of $50,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Gere's mother,Mrs.Williams.The Gere's could claim Mrs.Williams as their dependent,but she has too much gross income.  Mr.and Mrs.Gere (both age 40) received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Mr.and Mrs.Gere (both age 40) received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Definitions:

Dissociative Identity Disorder

A psychological condition characterized by the presence of two or more distinct personality states or identities within a single individual.

Sexual Abuse

Any unwanted sexual activity, with perpetrators using force, making threats, or taking advantage of victims not able to give consent.

Verbal Bullying

Bullying behavior that uses spoken words, threats, or name-calling to intimidate or humiliate someone.

Physical Bullying

A form of bullying involving direct physical contact and harm, such as hitting, kicking, or pushing.

Q10: Nitric oxide is made from the oxidation

Q11: Tyler (age 50)and Connie (age 48)are a

Q18: Accrual-basis taxpayers are allowed to deduct expenses

Q34: The molar mass of nitrogen (N<sub>2</sub>)is 28.0

Q39: What hydrate is sometimes referred to as

Q62: Donald has retired from his job as

Q62: In March of the current year,Marcus began

Q105: Jimmy owns a trucking business.During the current

Q120: What is or are the standards that

Q124: Tucker (age 52)and Elizabeth (age 48)are a