Phoebe's AGI for the current year is $120,000.Included in this AGI is $100,000 salary and $20,000 of interest income.In earning the investment income,Phoebe paid investment interest expense of $30,000.She also incurred the following expenditures subject to the 2% of AGI limitation:

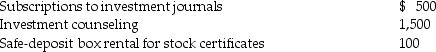

Investment expenses:

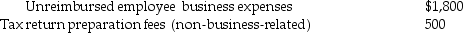

Non-investment expenses:

Non-investment expenses:

What is Phoebe's investment interest expense deduction for the year?

What is Phoebe's investment interest expense deduction for the year?

Definitions:

Average Cost

Average cost is the total cost of production divided by the number of goods produced, indicating the cost per unit of output.

Purely Competitive Firm

A firm that operates in a purely competitive market, characterized by many competitors, homogeneous products, and free market entry and exit.

Monopolistic Competitor

A firm that operates in a market with many other firms offering similar but not identical products, leading to competitive pricing and product differentiation.

Monopolistically Competitive

A market structure characterized by many firms selling similar but not identical products, allowing for some degree of market power and price control by individual firms.

Q4: If the outdoor temperature is 17.0°C,what is

Q7: The dimensions of a box are 1.2

Q17: A taxpayer incurs a net operating loss

Q18: Which one of the following substances is

Q69: When applying the limitations of the passive

Q71: Jack exchanged land with an adjusted basis

Q76: A taxpayer has generated a net operating

Q87: Patrick's records for the current year contain

Q107: Hobby expenses are deductible as for AGI

Q124: Kickbacks and bribes paid to federal officials