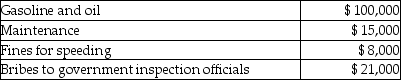

Jimmy owns a trucking business.During the current year he incurred the following:  The fines for speeding were a necessary cost because missing deadlines would cause lost business and are ordinary in the industry.What is the total amount of deductible expenses?

The fines for speeding were a necessary cost because missing deadlines would cause lost business and are ordinary in the industry.What is the total amount of deductible expenses?

Definitions:

Legal Advice

Guidance provided by a qualified legal professional regarding the law as it pertains to a specific situation or decision.

Date-Stamping

The process of marking documents, items, or electronic records with the specific date they were created, received, or processed.

Interviewing

The act of asking questions and eliciting information from a person, often used in research, journalism, or employment selection processes.

Associate Attorneys

Lawyers who are employed by a law firm but do not possess ownership or partnership status within the firm.

Q27: Hope sustained a $3,600 casualty loss due

Q29: Which of the following item(s)must be included

Q32: Jack takes a $7,000 distribution from his

Q54: Expenditures which do not add to the

Q78: If a taxpayer suffers a loss attributable

Q91: Sanjay is single and has taxable income

Q94: Gains realized from property transactions are included

Q106: Becky,a single individual,reports the following taxable items

Q123: In December of this year,Jake and Stockard,a

Q128: Joe is a self-employed tax attorney who