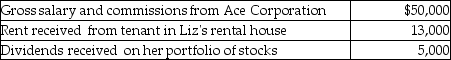

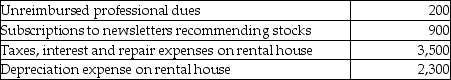

Liz,who is single,lives in a single family home and owns a second single family home that she rented for the entire year at a fair rental rate.Liz had the following items of income and expense during the current year. Income: Expenses:

Expenses: What is her adjusted gross income for the year?

What is her adjusted gross income for the year?

Definitions:

Q7: What is the correct name for PF<sub>5</sub>?<br>A)

Q30: Distinguish between the accrual-method taxpayer and the

Q35: Income from illegal activities is taxable.

Q44: A barometer is filled with a cylindrical

Q55: An accrual-basis taxpayer receives advance payment for

Q61: Erin,Sarah,and Timmy are equal partners in EST

Q63: What must an individual taxpayer prove to

Q68: Amy's employer provides her with several fringe

Q74: Chloe receives a student loan from a

Q97: This summer,Rick's home (which has a basis