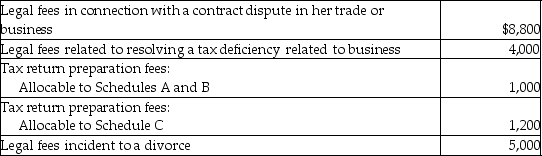

Leigh pays the following legal and accounting fees during the year:  What is the total amount of her for AGI deduction for these fees?

What is the total amount of her for AGI deduction for these fees?

Definitions:

Accounts Payable

Liabilities of a business that are due to be paid to creditors within a certain period.

Long-Term Debt

Financial obligations of a company that are due more than one year in the future, often used for significant projects or to purchase assets.

Debt-Equity Ratio

A ratio indicating a firm's financial leverage, determined by dividing its total debts by its shareholder equity.

Accounts Receivable Turnover

A financial ratio that measures how efficiently a company collects revenue from its customers by dividing total net credit sales by the average accounts receivable.

Q5: What is the correct name for K<sub>3</sub>PO<sub>4</sub>?<br>A)

Q7: Frank is a self-employed CPA whose 2016

Q27: Margaret,a single taxpayer,operates a small pottery activity

Q28: Melanie,a single taxpayer,has AGI of $220,000 which

Q30: Brienne sells land to her brother,Abe,at a

Q34: What is the correct formula for an

Q85: Interest expense incurred in the taxpayer's trade

Q88: Fees paid to prepare a taxpayer's Schedule

Q104: An individual is considered to materially participate

Q138: List those criteria necessary for an expenditure