During the current year,Lucy,who has a sole proprietorship,pays legal and accounting fees for the following:

Services rendered in resolving a federal tax deficiency

Services rendered in resolving a federal tax deficiency

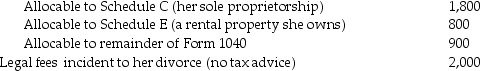

Tax return preparation fees:

Tax return preparation fees:

What amount is deductible for AGI?

What amount is deductible for AGI?

Definitions:

Systematic Desensitization

A therapeutic technique aimed at reducing anxiety by gradually exposing the patient to the anxiety-provoking stimulus.

Causal Attribution

The process by which individuals explain the cause or reasons behind events and behaviors, often categorizing them as internal or external.

Continuous Reinforcement Schedule

A learning paradigm where every correct response is followed by a reward, facilitating rapid behavior acquisition.

Partial Reinforcement Schedule

A learning process in which a response is reinforced only a portion of the time, leading to stronger behavioral persistence.

Q3: Discuss why the distinction between deductions for

Q3: If a taxpayer's method of accounting does

Q30: Brienne sells land to her brother,Abe,at a

Q41: Faye earns $100,000 of AGI,including $90,000 of

Q49: A taxpayer suffers a casualty loss on

Q70: Educational expenses incurred by a CPA for

Q77: In September of 2016,Michelle sold shares of

Q87: A nonbusiness bad debt is deductible only

Q90: Employees receiving nonqualified stock options recognize ordinary

Q111: During the current year,Don's aunt Natalie gave