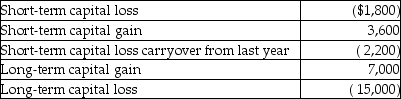

During the current year,Nancy had the following transactions:  What is the amount of her capital loss deduction for the current year,and what is the amount and character of her capital loss carryover?

What is the amount of her capital loss deduction for the current year,and what is the amount and character of her capital loss carryover?

Definitions:

Violent Video Games

Games that involve scenes of conflict with the use of physical force or violence to achieve objectives.

Aggressive Behavior

A range of actions that can result in harm or damage, driven by intent to dominate, harm, or assert power.

Word-completion Task

A psychological test in which participants are asked to fill in the blanks in a list of incomplete words.

Encoding Specificity Principle

A principle in psychology that states the recall of information is improved if cues received at the time of recall are consistent with those present at the time of encoding.

Q5: Erik purchased qualified small business corporation stock

Q6: Which of the following is not included

Q7: Which one of the following is a

Q12: Which of the following credits is considered

Q15: The amount of loss realized on the

Q38: In order to be recognized and deducted

Q65: Raoul sells household items on an Internet

Q85: Interest expense incurred in the taxpayer's trade

Q90: Justin has AGI of $110,000 before considering

Q122: Kelsey is a cash-basis,calendar-year taxpayer.Her salary is