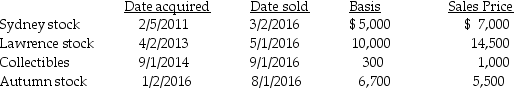

Chen had the following capital asset transactions during 2016:

What is the adjusted net capital gain or loss and the related tax due to the above transactions,assuming Chen has a 25% marginal tax rate?

What is the adjusted net capital gain or loss and the related tax due to the above transactions,assuming Chen has a 25% marginal tax rate?

Definitions:

Required Production

The quantity of goods a company needs to produce in a specific period to meet its sales goals and inventory requirements.

Budgeted Sales

Budgeted sales refer to the projected amount of sales (in units or revenue) that a company expects to achieve within a certain period, as outlined in its budget.

Credit Sales

Sales transactions in which the purchase amount is charged to the buyer’s account, to be paid at a later date.

Finished Goods Inventory

The stock of completed products that are ready to be sold to customers.

Q14: A taxpayer reports capital gains and losses

Q53: If property received as a gift has

Q58: Adjusted net capital gain is taxed at

Q62: A taxpayer guarantees another person's obligation and

Q64: A married person who files a separate

Q72: The standard deduction is the maximum amount

Q86: Lori had the following income and losses

Q88: Kendrick,who has a 33% marginal tax rate,had

Q97: Jordan paid $30,000 for equipment two years

Q125: American Healthcare (AH),an insurance company,is trying to