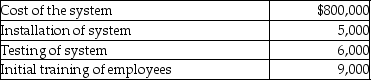

Terra Corp.purchased a new enterprise software system and incurred the following costs:  What is Terra Corp.'s basis in the software system?

What is Terra Corp.'s basis in the software system?

Definitions:

Fissure

A small tear in the lining of an organ, such as the skin or the lining of the anus.

Sinus

Cavities or air spaces within the bones of the skull and face that are connected to the nasal cavities, playing roles in respiration and the production of mucus.

Tubercle

A small rounded projection or nodule, especially one that is part of the structure of a bone.

Genu Valgum

A medical condition characterized by the inward angulation of the knees, commonly referred to as "knock-knees."

Q5: Erik purchased qualified small business corporation stock

Q28: Speak Corporation,a calendar year accrual-basis taxpayer,sell packages

Q45: Frank and Marion,husband and wife,file separate returns.Frank

Q49: On July 25,2015,Karen gives stock with a

Q57: What options are available for reporting and

Q58: Adjusted net capital gain is taxed at

Q75: A married taxpayer may file as head

Q87: Jan has been assigned to the Rome

Q100: Each year a taxpayer must include in

Q110: Losses incurred in the sale or exchange