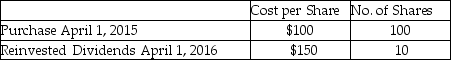

Rachel holds 110 shares of Argon Mutual Fund.She is planning to sell 90 shares.Her record of the share purchases is noted below.What could be her basis for the 90 shares to be sold for purposes of determining gain?

Definitions:

Employment Opportunities

Job openings available in the economy for individuals seeking employment, reflecting the demand for labor and the health of the economic environment.

Taft-Hartley Act

A U.S. law enacted in 1947 that restricts the activities and power of labor unions.

Labor Relations (Wagner) Act

A foundational statute of US labor law which guarantees the rights of private sector employees to organize into trade unions, engage in collective bargaining, and take collective action such as strikes.

1930s

The decade from 1930 to 1939, characterized by the Great Depression worldwide, economic hardship, and in some places, political instability.

Q39: Gwen's marginal tax bracket is 25%.Gwen pays

Q44: On July 1 of the current year,Marcia

Q44: For purposes of applying the passive loss

Q53: Efrain owns 1,000 shares of RJ Inc.common

Q67: Keith,age 17,is a dependent of his parents.During

Q86: Carl purchased a machine for use in

Q92: Carter dies on January 1,2016.A joint return

Q116: A loss incurred on the sale or

Q118: Amber supports four individuals: Erin,her stepdaughter,who lives

Q133: Losses are generally deductible if incurred in