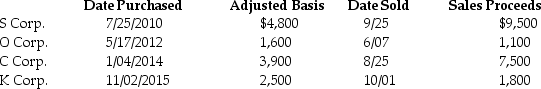

Mike sold the following shares of stock in 2016:

What are the tax consequences of these transactions,assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

What are the tax consequences of these transactions,assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

Definitions:

Perfectly Inelastic

A market condition where the quantity demanded or supplied is unresponsive to price changes, depicted graphically as a vertical line.

Supply

The total amount of a product or service available for purchase at any given price level.

Inflation Rate

The percentage rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling.

Nominal Rate

The interest rate unadjusted for inflation; the face value rate expressed as a percentage.

Q1: Gabe Corporation,an accrual-basis taxpayer that uses the

Q10: May an individual deduct a charitable contribution

Q34: In order to shift the taxation of

Q45: Frank and Marion,husband and wife,file separate returns.Frank

Q55: Bob owns 100 shares of ACT Corporation

Q57: What options are available for reporting and

Q65: Generally,gains resulting from the sale of collectibles

Q110: When two or more people qualify to

Q132: On January 31 of this year,Jennifer pays

Q149: Indicate for each of the following the