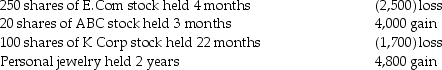

Trista,a taxpayer in the 33% marginal tax bracket sold the following capital assets this year:

What is the amount of and nature of (LT or ST)capital gain or loss? Be specific as to the rates at which gains,if any,are taxed.

What is the amount of and nature of (LT or ST)capital gain or loss? Be specific as to the rates at which gains,if any,are taxed.

Definitions:

ASPE

Accounting Standards for Private Enterprises, which provide simplified accounting guidelines for private companies in Canada.

Goodwill Impairment

A decrease in the value of goodwill on a company’s balance sheet, indicating that the value of a company’s acquired assets has fallen below the original valuation.

Revalued Assets

Assets that have been appraised again to reflect their current market value, rather than their original cost.

Consolidated Financial Statements

Financial statements that aggregate the financial position and results of a parent company and its subsidiaries, presenting as if the group were a single entity.

Q9: Five different capital gain tax rates could

Q28: Speak Corporation,a calendar year accrual-basis taxpayer,sell packages

Q44: Greg is the owner and beneficiary of

Q58: Adjusted net capital gain is taxed at

Q61: Erin,Sarah,and Timmy are equal partners in EST

Q66: A legally married same-sex couple can file

Q108: Buzz is a successful college basketball coach.In

Q126: Todd and Hillary,husband and wife,file separate returns.Todd

Q129: Investment interest expense is deductible when incurred

Q135: Section 1221 specifically states that inventory or