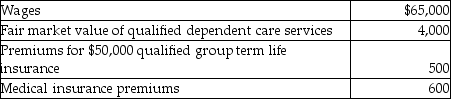

Carl filed his tax return,properly claiming the head of household filing status.Carl's employer paid or provided the following to Carl:  How much of this income should Carl report (assume benefits are provided on a nondiscriminatory basis) ?

How much of this income should Carl report (assume benefits are provided on a nondiscriminatory basis) ?

Definitions:

Judicial Scrutiny

The careful examination or review by a court, particularly regarding the constitutionality of laws and government actions.

Senate Judiciary Committee

A standing committee of the U.S. Senate responsible for overseeing judicial administration, including federal court nominations.

Federal Judgeship

A position that involves serving as a judge within the federal judiciary of a country, appointed to interpret and apply federal laws and the constitution.

Unanimous Vote

A voting outcome where all participants agree and there are no dissenting voices.

Q25: The Current Model most closely describes a

Q43: In February of the current year (assume

Q43: Amanda,whose tax rate is 33%,has NSTCL of

Q48: Andrea died with an unused capital loss

Q61: Explain under what circumstances meals and lodging

Q67: If an indivdual taxpayer's net long-term capital

Q68: On August 1 of this year,Sharon,a cash

Q87: A nonbusiness bad debt is deductible only

Q132: On January 31 of this year,Jennifer pays

Q135: Section 1221 specifically states that inventory or