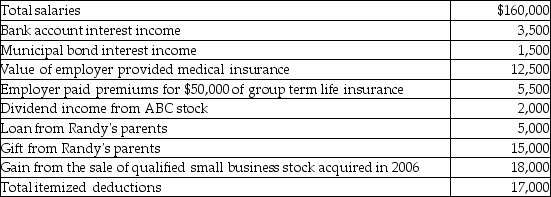

Randy and Sharon are married and have two dependent children.Their 2016 tax and other related information is as follows:

Compute Randy and Sharon's taxable income.(Show all calculations in good form. )

Compute Randy and Sharon's taxable income.(Show all calculations in good form. )

Definitions:

Conglomerate Merger

A merger in which a company merges with another company that is not a competitor or a buyer or seller to the company.

Sherman Act

A United States antitrust law passed in 1890 that prohibits monopolistic practices and promotes competition.

Horizontal Restraint

A type of anti-competitive practice that occurs between businesses at the same level of the supply chain, such as agreements between competitors to fix prices or divide markets.

Market Extension Merger

A merger between companies in similar industries but different markets, aimed at expanding the market reach of products or services.

Q6: Torrie and Laura form a partnership in

Q7: Which one of the following is a

Q7: In 2016 the IRS audits a company's

Q28: Discuss when expenses are deductible under the

Q35: All of the following items are generally

Q48: Self-employed individuals may claim,as a deduction for

Q51: Lars has a basis in his partnership

Q55: For purposes of the dependency exemption,a qualifying

Q102: Amounts collected under accident and health insurance

Q122: A key factor in determining tax treatment