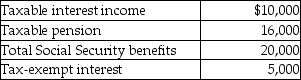

Mr.& Mrs.Tsayong are both over 66 years of age and are filing a joint return.Their income this year consisted of the following:  They did not have any adjustments to income.What amount of Mr.& Mrs.Tsayongs Social Security benefits is taxable this year?

They did not have any adjustments to income.What amount of Mr.& Mrs.Tsayongs Social Security benefits is taxable this year?

Definitions:

Fiscal Year

A one-year period used for financial reporting and budgeting, which does not necessarily coincide with the calendar year.

Principal Repayment

The portion of a loan payment that goes toward reducing the amount borrowed, not including interest.

Federal Income Tax

A tax levied by the United States federal government on the annual earnings of individuals, corporations, trusts, and other legal entities.

Withheld

The portion of an employee's income that an employer retains as mandated by law or agreement, typically for taxes or other deductions.

Q8: Carole owns 75% of Pet Foods,Inc.As CEO,Carole

Q24: Property settlements made incident to a divorce

Q30: Natasha is a single taxpayer with a

Q32: On August 1 of the current year,Terry

Q34: The Roth IRA is an example of

Q40: If t<sub>0</sub> is the tax rate in

Q59: Anita,who is divorced,maintains a home in which

Q72: Small Corporation had the following capital gains

Q75: Earnings of a minor child are taxed

Q142: In 2014 Toni purchased 100 shares of