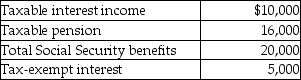

Mr.& Mrs.Tsayong are both over 66 years of age and are filing a joint return.Their income this year consisted of the following:  They did not have any adjustments to income.What amount of Mr.& Mrs.Tsayongs Social Security benefits is taxable this year?

They did not have any adjustments to income.What amount of Mr.& Mrs.Tsayongs Social Security benefits is taxable this year?

Definitions:

Investment Company

A trust or corporation that focuses on deploying the aggregated investments of individuals into financial securities.

Mutual Fund Assets

The total market value of all financial assets held by a mutual fund.

Equity Funds

Investment funds that primarily invest in stocks, aiming to provide investors with capital growth or income through equity ownership.

Bond Funds

Mutual funds that invest primarily in bonds with the aim of generating income for their investors.

Q8: In 2014 Betty loaned her son,Juan,$10,000 to

Q16: Improvements to leased property made by a

Q20: Hannah is single with no dependents and

Q24: Joe Black,a police officer,was injured in the

Q27: While tax-exempt bonds are not subject to

Q55: Bob owns 100 shares of ACT Corporation

Q56: Which of the following is not required

Q76: Distinguish between the Corn Products doctrine and

Q116: Kadeisha is single with no dependents and

Q121: Refundable tax credits are allowed to reduce