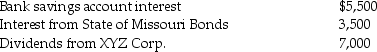

Kevin is a single person who earns $70,000 in salary for 2016 and has other income from a variety of investments,as follows:

Kevin received tax refunds when he filed his 2015 tax returns in April 2016.His federal refund was $600 and his state refund was $300.Kevin deducted his stated taxes paid in 2015 as an itemized deduction on his 2015 return.Due to changes in circumstances,Kevin is not itemizing deductions on his 2016 return.

Kevin received tax refunds when he filed his 2015 tax returns in April 2016.His federal refund was $600 and his state refund was $300.Kevin deducted his stated taxes paid in 2015 as an itemized deduction on his 2015 return.Due to changes in circumstances,Kevin is not itemizing deductions on his 2016 return.

Compute Kevin's taxable income for 2016.

Definitions:

Payments

The act of transferring money or consideration from one party to another in exchange for goods, services, or to settle a debt.

Business Practices

Established methods or manners of operating within a business or industry.

Credit-Worthiness

An assessment of an individual's or entity's ability to repay borrowed money, often based on their financial history and current resources.

Merchants

Individuals or entities involved in the wholesale or retail sale of goods.

Q26: Under the terms of a divorce agreement

Q27: CT Computer Corporation,a cash-basis taxpayer,sells service contracts

Q70: Renee is single and has taxable income

Q91: Voluntary revocation of an S corporation election

Q91: A taxpayer opens a new business this

Q97: Ms.Marple's books and records for 2016 reflect

Q104: Charlie is claimed as a dependent on

Q110: When two or more people qualify to

Q131: Stephanie owns a 25% interest in a

Q131: In a community property state,jointly owned property