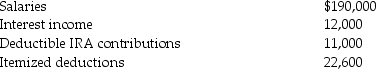

The following information is available for Bob and Brenda Horton,a married couple filing a joint return,for 2016.Both Bob and Brenda are age 32 and have no dependents.

a.What is the amount of their gross income?

a.What is the amount of their gross income?

b.What is the amount of their adjusted gross income?

c.What is the amount of their taxable income?

d.What is the amount of their tax liability (gross tax)?

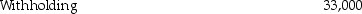

e.What is the amount of their tax due or (refund due)?

Definitions:

Adjustment Message

Communication designed to inform about alterations in services, policies, or agreements, often aiming to resolve issues or update stakeholders.

Apology

An expression of regret or sorrow for having wronged someone, usually accompanied by an attempt to make amends for the actions.

Claim Message

A communication, often in written form, asserting a right or demand for resolution, typically in business or legal contexts.

Banquet

A large, formal meal for many people, often followed by speeches or entertainment.

Q22: A taxpayer can receive innocent spouse relief

Q35: If "R" equals the before-tax rate of

Q61: In 2006,Gita contributed property with a basis

Q62: "Working condition fringe benefits," such as memberships

Q78: Nate and Nikki have three dependent children

Q90: A shareholder's deduction for ordinary losses and

Q98: In 2016,Richard,a single taxpayer,has adjusted gross income

Q107: The tax law encourages certain forms of

Q116: Thomas and Sally were divorced last year.As

Q146: The expenses associated with promoting and marketing