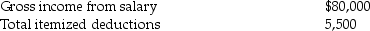

Steve Greene,age 66,is divorced with no dependents.In 2016 Steve had income and expenses as follows:

Compute Steve's taxable income for 2016.Show all calculations.

Compute Steve's taxable income for 2016.Show all calculations.

Definitions:

Traditional Economist

An expert in economics who focuses on theories and models that adhere to classical and neoclassical principles, valuing market equilibrium and rational decision-making.

Evaluation Apprehension

Anxiety or concern about being judged by others, often affecting performance in tasks or decisions.

Deindividuation

Deindividuation refers to a psychological state where an individual loses self-awareness and a sense of individuality, often leading to uninhibited or norm-defying behavior, usually in group settings.

Anonymous

Describing someone or something that is unnamed or not identified by name, often used to maintain privacy or confidentiality.

Q11: Assuming a calendar tax year and the

Q42: As a result of a divorce,Matthew pays

Q46: Savings accounts and money market funds are

Q50: Mark purchased 2,000 shares of Darcy Corporation

Q64: A flow-through entity's primary characteristic is that

Q67: The formula for the after-tax accumulation (ATA)for

Q70: The corporate built-in gains tax does not

Q108: In a basket purchase,the total cost is

Q113: Blaine Greer lives alone.His support comes from

Q131: Identify which of the following statements is