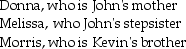

John supports Kevin,his cousin,who lived with him throughout 2016.John also supports three other individuals who do not live with him:  Assume that Donna,Melissa,Morris and Kevin each earn less than $4,050.How many personal and dependency exemptions may John claim?

Assume that Donna,Melissa,Morris and Kevin each earn less than $4,050.How many personal and dependency exemptions may John claim?

Definitions:

Physical Capabilities

The capacity of an individual to perform tasks or activities that require physical effort or skill.

Geographic Boundaries

Physical or imaginary lines that define the spatial extent of territories, countries, states, or municipalities.

Global Competition

The dynamic rivalry between companies from different countries in the global market, involving price, product quality, and customer service.

Social Institutions

Structures or mechanisms of social order and cooperation governing the behavior of a set of individuals within a given community.

Q1: The most common AMT adjustments for corporations

Q27: Tina purchases a personal residence for $278,000,but

Q44: Speak Corporation,a calendar year cash-basis taxpayer,sells packages

Q62: If certain requirements are met,Sec.351 permits deferral

Q76: Sharisma suffered a serious stroke and was

Q105: An individual buys 200 shares of General

Q114: Silver Inc.is an S corporation.This year it

Q116: In the case of foreign-earned income,U.S.citizens may

Q121: Jade is a single taxpayer in the

Q127: CT Computer Corporation,an accrual-basis taxpayer,sells service contracts