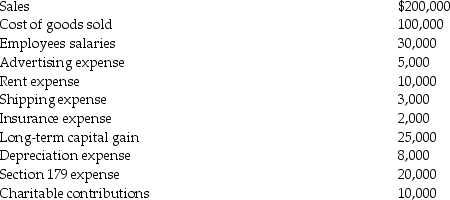

Longhorn Partnership reports the following items at the end of the current year:

What is the partnership's ordinary income? Which items are separately-stated?

What is the partnership's ordinary income? Which items are separately-stated?

Definitions:

Program Revenues

Income directly generated by specific programs or services, typically reported by governmental entities to reflect how resources are tied to particular activities.

Fiscally Independent

Having the authority to raise revenue through taxation and make spending decisions independently, typically referring to governmental units.

CAFR

The Comprehensive Annual Financial Report, a set of U.S. government financial statements that provides a detailed presentation of a state, municipality, or other governmental entity's financial condition.

Introductory

Pertaining to the beginning or initial stage of something, often used to describe the initial phase of a project, course, or period.

Q23: Chen contributes a building worth $160,000 (adjusted

Q35: Hong earns $127,300 in her job as

Q44: Stephanie owns a 25% interest in a

Q51: Shafiq,age 16,works part-time at the local supermarket

Q64: Worthy Corporation elected to be taxed as

Q72: Which one of the following items is

Q109: Is it possible for the Tax Court

Q120: An S corporation distributes land to its

Q129: The regular standard deduction is available to

Q143: Ordinary losses and separately stated deduction and