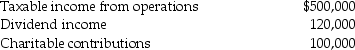

Concepts Corporation reported the following results for the current year:

Taxable income from operations does not include the dividend income or the contributions.The dividend income is from minor investments in U.S.publicly-traded stocks.Calculate Concept Corporation's taxable income and any carryovers that may be generated.

Taxable income from operations does not include the dividend income or the contributions.The dividend income is from minor investments in U.S.publicly-traded stocks.Calculate Concept Corporation's taxable income and any carryovers that may be generated.

Definitions:

Taxable Income

The amount of income that is used to calculate how much tax an individual or a company owes to the government.

Progressive

Referring to policies or tax rates that increase proportionally with the ability to pay, targeting a higher burden on wealthier entities or individuals.

Price Elasticity

A measure of how much the quantity demanded of a good responds to a change in the price of that good, often used to understand the sensitivity of demand in relation to price changes.

Excise Tax

A form of taxation applied on certain goods, services, or activities, often included in the price of products like gasoline, alcohol, and tobacco.

Q2: Identify which of the following statements is

Q38: Heidi invests $1,000 in a taxable bond

Q38: Jing,who is single,paid educational expenses of $16,000

Q53: Bob owns a warehouse that is used

Q54: If the accumulated depreciation on business equipment

Q54: The basis of non-like-kind property received is

Q96: Cheryl is claimed as a dependent on

Q98: The primary citation for a federal circuit

Q111: During the year,Jim incurs $500,000 of rehabilitation

Q114: Silver Inc.is an S corporation.This year it