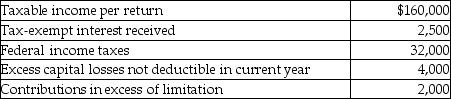

Greg Corporation,an accrual method taxpayer,had accumulated earnings and profits of $300,000 as of December 31,last year.For its current tax year,Greg's books and records reflect the following:  Based on the above,what is the amount of Greg Corporation's current earnings and profits for this year?

Based on the above,what is the amount of Greg Corporation's current earnings and profits for this year?

Definitions:

Religion

A set of beliefs, practices, and moral codes related to the worship of or belief in a supernatural power or powers considered to be divine or sacred.

Cognitive Dissonance

The psychological unease felt when an individual simultaneously possesses conflicting beliefs, ideas, or values.

Dissonance

A state of conflict or inconsistency between one's beliefs, attitudes, or actions, often leading to discomfort and change.

Textbook

A published collection of scholarly written material covering particular subjects, often used for academic study.

Q20: The holding period of like-kind property received

Q26: Where non-like-kind property other than cash is

Q49: Individuals Bert and Tariq form Shark Corporation.Bert

Q54: Given that D<sub>n</sub> is the amount of

Q59: All of the following are self-employment income

Q60: Michelle,age 20,is a full-time college student with

Q68: Brittany receives a nonliquidating distribution of $48,000

Q76: Although exclusions are usually not reported on

Q79: Section 1231 property will generally have all

Q83: Stephanie's building,which was used in her business,was