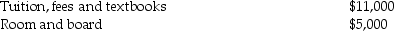

Tom and Anita are married,file a joint return with an AGI of $165,000,and have one dependent child,Tim,who is a first-time freshman in college.The following expenses are incurred and paid in 2016:

What is the maximum education credit allowed to Tom and Anita?

What is the maximum education credit allowed to Tom and Anita?

Definitions:

Participative Leadership

A leadership approach that encourages the participation of team members in decisions, promoting teamwork and shared accountability.

High-performance Culture

An organizational culture characterized by an intense focus on performance metrics, excellence, teamwork, and achieving superior outcomes.

Service

Aid and assistance provided to others; concern for the well-being and the best interest of another person or group.

Caring Leadership

An approach to leadership that emphasizes empathy, support, and concern for the well-being of team members.

Q15: Gain due to depreciation recapture is included

Q18: On June 30,2016,Temika purchased office furniture (7-year

Q26: A corporation's regular taxable income for the

Q64: Ron transfers assets with a $100,000 FMV

Q67: Discuss the conflict between advocacy for a

Q75: Scott provides accounting services worth $40,000 to

Q81: Harley's tentative minimum tax is computed by

Q88: On July 1,Joseph,a 10% owner,sells his interest

Q110: In 1980,Artima Corporation purchased an office building

Q126: Tess buys Harry's partnership interest in Oval