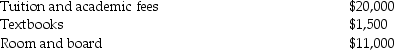

Burton and Kay are married,file a joint return with an AGI of $115,000,and have one dependent child,Tyler,who is a full-time student in a Master of Accountancy program.The following expenses relate to his costs of attendance in 2016:

The tuition noted above is the gross amount charged before reduction for his $5,000 tuition scholarship.What is the maximum education credit allowed to Burton and Kay?

The tuition noted above is the gross amount charged before reduction for his $5,000 tuition scholarship.What is the maximum education credit allowed to Burton and Kay?

Definitions:

Individual Sins

Acts committed by an individual that transgress moral or religious laws.

Second Industrial Revolution

A phase of rapid industrialization in the late 19th and early 20th centuries, marked by the widespread adoption of steel, electric power, and advanced machinery.

Economic Differences

Variations in wealth, income, or economic structures between individuals, regions, or countries.

James Blaine

James Blaine was a prominent American politician and statesman in the late 19th century, who served as Speaker of the House, a U.S. Senator from Maine, and Secretary of State, and was the Republican nominee for president in 1884.

Q7: Luke's offshore drilling rig with a $700,000

Q18: Which of the following statements regarding UNICAP

Q19: To receive S corporation treatment,a qualifying shareholder

Q39: In calculating depletion of natural resources each

Q47: Jack purchases land which he plans on

Q58: Heather purchased undeveloped land to drill for

Q75: Cassie owns a Rembrandt painting she acquired

Q83: Minna is a 50% owner of a

Q84: Under what circumstances can a taxpayer obtain

Q103: Elise contributes property having a $60,000 FMV