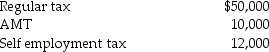

Beth and Jay project the following taxes for the current year:

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

a.Preceding tax year-AGI of $140,000 and total taxes of $36,000.

b.Preceding tax year-AGI of $155,000 and total taxes of $48,000.

Definitions:

Conduction Deafness

Hearing loss that occurs when sound waves cannot be efficiently conducted through the outer ear canal to the eardrum and the tiny bones of the middle ear.

Eardrum

A thin membrane that separates the outer ear from the middle ear and vibrates in response to sound waves, enabling hearing.

Basilar Membrane

The basilar membrane is a critical component of the inner ear, situated within the cochlea; it plays a substantial role in the mechanical analysis of sound waves for hearing.

Cochlea

A spiral-shaped cavity in the inner ear, containing the organ responsible for converting sound waves into nerve signals perceived as sound by the brain.

Q14: When accounting for long-term contracts (other than

Q29: Which of the following is not a

Q35: Hong earns $127,300 in her job as

Q51: In order to be considered Sec.1231 property,all

Q52: Jamahl has a 65% interest in a

Q95: The alternative minimum tax applies to individuals

Q96: Prior Corp.plans to change its method of

Q102: A taxpayer at risk for AMT should

Q111: Octet Corporation placed a small storage building

Q119: If a corporation has no E&P,a distribution