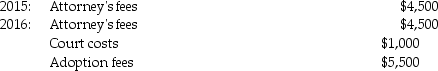

Tyler and Molly,who are married filing jointly with $210,000 of AGI in 2016,incurred the following expenses in their efforts to adopt a child:

The adoption was finalized in 2016 What is the amount of the allowable adoption credit in 2016?

The adoption was finalized in 2016 What is the amount of the allowable adoption credit in 2016?

Definitions:

Organization Design

The process of structuring and arranging the components of a company or organization to achieve its objectives efficiently and effectively.

Traditional Forms

Conventional or long-established methods, practices, or art forms that are passed down through generations.

Evolution Circumstances

Factors or conditions that influence the adaptive changes and development of organisms, systems, or processes over time.

Network Design

The planning and structuring of a network, including the selection of hardware and software to meet the requirements and objectives of an organization.

Q14: Assume a taxpayer projects that his total

Q19: Pete sells equipment for $15,000 to Marcel,his

Q20: The additional recapture under Sec.291 is 25%

Q29: A taxpayer must use the same accounting

Q37: Eric purchased a building in 2005 that

Q62: The primary purpose of a partnership tax

Q78: Kai owns an apartment building held for

Q80: Land,buildings,equipment,and common stock are examples of tangible

Q105: A taxpayer will be ineligible for the

Q143: Individuals Opal and Ben form OB Corporation.Opal