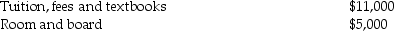

Tom and Anita are married,file a joint return with an AGI of $165,000,and have one dependent child,Tim,who is a first-time freshman in college.The following expenses are incurred and paid in 2016:

What is the maximum education credit allowed to Tom and Anita?

What is the maximum education credit allowed to Tom and Anita?

Definitions:

Foreign Corrupt Practices Act

A United States law aimed at preventing American companies from engaging in bribery and other unethical practices in foreign countries to obtain or retain business.

Facilitation Payments

These are small sums of money paid to expedite or secure the performance of routine governmental actions by officials, often viewed as a form of bribery in many jurisdictions.

Cultural Differences

Variations in the norms, values, beliefs, and practices among different groups, societies, or individuals, arising from ethnic, racial, socioeconomic, geographical, or other distinctions.

Ethical Issues

Concerns or dilemmas that involve principles of right and wrong behavior.

Q23: In July of 2016,Pat acquired a new

Q27: What is the purpose of Sec.1245 and

Q70: Discuss the basis rules of property received

Q80: The general business credit includes all of

Q101: With respect to charitable contributions by corporations,all

Q106: Gains and losses from involuntary conversions of

Q108: Depreciable property used in a trade or

Q115: Yael exchanges an office building worth $150,000

Q121: Advance approval and the filing of Form

Q143: Bob's income can vary widely from year-to-year