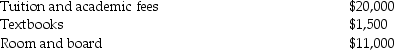

Burton and Kay are married,file a joint return with an AGI of $115,000,and have one dependent child,Tyler,who is a full-time student in a Master of Accountancy program.The following expenses relate to his costs of attendance in 2016:

The tuition noted above is the gross amount charged before reduction for his $5,000 tuition scholarship.What is the maximum education credit allowed to Burton and Kay?

The tuition noted above is the gross amount charged before reduction for his $5,000 tuition scholarship.What is the maximum education credit allowed to Burton and Kay?

Definitions:

Dermatomal Maps

Diagrams that show the area of skin supplied by sensory nerves stemming from a single spinal nerve root.

Nerve Damage

Injury to the nerves, often resulting in loss of movement, sensation, or function in the affected area.

Spinal Nerve Pairs

The 31 pairs of nerves that emerge from the spinal cord, transmitting motor, sensory, and autonomic signals between the spinal cord and the body.

Cervical

Relating to the cervix, the lower part of the uterus that opens into the vagina, or relating to the neck region of the spine.

Q2: Identify which of the following statements is

Q17: The child and dependent care credit provides

Q20: The all-events test requires that the accrual-basis

Q32: June Corporation has the following income and

Q41: Which of the following statements is not

Q64: George and Meredith who are married,have a

Q71: Enrico is a self-employed electrician.In May of

Q79: Intangible assets are subject to MACRS depreciation.

Q90: All of the following are true with

Q111: Under the cash method of accounting,income is