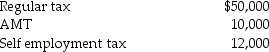

Beth and Jay project the following taxes for the current year:

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

a.Preceding tax year-AGI of $140,000 and total taxes of $36,000.

b.Preceding tax year-AGI of $155,000 and total taxes of $48,000.

Definitions:

Q9: Bert,a self-employed attorney,is considering either purchasing or

Q10: Which of the following businesses is most

Q16: Nonrefundable tax credits<br>A)only offset a taxpayer's tax

Q19: To receive S corporation treatment,a qualifying shareholder

Q36: A corporation is owned 70% by Jones

Q38: Which of the following characteristics can disqualify

Q40: If an individual is an employee and

Q95: On January 1 of the current year,Dentux

Q109: Passive activity loss limitations apply to S

Q113: John contributes land having $110,000 FMV and