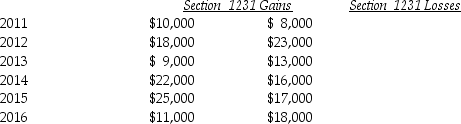

Lucy,a noncorporate taxpayer,experienced the following Section 1231 gains and losses during the years 2011 through 2016.Her first disposition of a Sec.1231 asset occurred in 2011.Assuming Lucy had no capital gains and losses during that time period,what is the tax treatment in each of the years listed?

Definitions:

Fin-Syn Rule

A set of regulations by the FCC that prevented television networks from owning the syndication rights to their own programming content.

Independent Producers

Independent producers are individuals or companies that create content or media such as films, music, or television shows outside of the major studio systems.

Government Regulation

The act of controlling, directing, or managing activities, often through rules and regulations, by government entities.

Media Ownership

The control or possession of media companies by individuals or corporations, which impacts the diversity of viewpoints presented.

Q7: A large SUV is place in service

Q33: Ross purchased a building in 1985,which he

Q39: In calculating depletion of natural resources each

Q44: Emily made the following interest free loans

Q48: Sec.1245 can increase the amount of gain

Q54: If the accumulated depreciation on business equipment

Q75: In computing a corporation's NOL,the dividends-received deduction

Q81: In 1998,Congress passed legislation concerning shifting the

Q83: Stephanie's building,which was used in her business,was

Q87: A couple has filed a joint tax