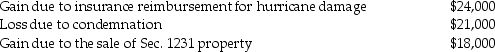

The following gains and losses pertain to Jimmy's business assets that qualify as Sec.1231 property.Jimmy does not have any nonrecaptured net Sec.1231 losses from previous years,and the portion of gain recaptured as ordinary income due to the depreciation recapture provisions has been eliminated.

Describe the specific tax treatment of each of these transactions.

Describe the specific tax treatment of each of these transactions.

Definitions:

False Memory Syndrome

A condition in which a person's identity and relationships are affected by strongly believed but entirely fabricated memories of traumatic events.

Nondeclarative Memories

A type of long-term memory that doesn't require conscious thought to recall, such as skills and experiences, also known as procedural memory.

Prefrontal Lobes

The front part of the frontal lobes of the brain, involved in higher cognitive functions such as decision making, planning, and moderating social behavior.

Temporal Lobes

The regions of the brain located beneath the Sylvian fissure on both cerebral hemispheres, involved in processing auditory information and encoding memory.

Q6: Which of the following is not a

Q7: Summer Corporation has the following capital gains

Q28: Lara started a self-employed consulting business in

Q30: The health insurance premium assistance credit is

Q45: The installment method is not applicable to

Q51: In order to be considered Sec.1231 property,all

Q60: When computing a corporation's alternative minimum taxable

Q62: Leonard established a trust for the benefit

Q100: Summer exchanges an office building used in

Q101: Inventory may be valued on the tax