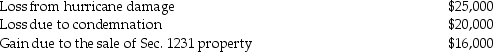

The following gains and losses pertain to Arnold's business assets that qualify as Sec.1231 property.Arnold does not have any nonrecaptured net Sec.1231 losses from previous years,and the portion of gain recaptured as ordinary income due to the depreciation recapture provisions has been eliminated.

Describe the specific tax treatment of each of these transactions.

Describe the specific tax treatment of each of these transactions.

Definitions:

Population Increase

The growth in the number of individuals in a population, often discussed in the context of environmental, economic, and social implications.

Stressful Family Circumstances

Situations within a family that cause stress, tension, or conflict among its members.

Reduced Mental Ability

A decrease in cognitive function that may affect memory, reasoning, and other mental activities.

Heritability

A statistic used in genetics to estimate the degree to which variation in a trait across a population is due to genetic differences among individuals.

Q11: Reva and Josh Lewis had alternative minimum

Q40: Xerxes Manufacturing,in its first year of operations,produces

Q44: A citator is used to find<br>A)the judicial

Q45: During the year 2016,a calendar year taxpayer,Marvelous

Q53: Bob owns a warehouse that is used

Q53: Appeals from the Court of Appeals go

Q54: The basis of non-like-kind property received is

Q77: Owners of pass-through entities may defer income

Q98: If a taxpayer's total tax liability is

Q105: Arnie is negotiating the sale of land