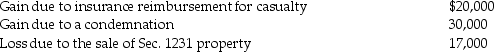

The following are gains and losses recognized in 2016 on Ann's business assets that were held for more than one year.The assets qualify as Sec.1231 property.

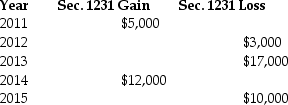

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

Describe the specific tax treatment of each of the current year transactions.

Describe the specific tax treatment of each of the current year transactions.

Definitions:

Monopolist

An entity that is the sole provider of a particular product or service in the market, having significant control over pricing.

Deadweight Loss

A loss of economic efficiency that can occur when the free market equilibrium for a good or a service is not achieved.

Society's Welfare

The overall well-being and quality of life of the people within a society, including factors like health, happiness, and economic prosperity.

Socially Efficient

A market condition where resources are allocated in a way that maximizes the overall benefit to society.

Q12: Which of the following statements is not

Q21: Eric exchanges a printing press with an

Q39: Identify which of the following statements is

Q45: The terms "progressive tax" and "flat tax"

Q59: When a taxpayer contacts a tax advisor

Q59: Interest is not imputed on a gift

Q64: Off-the-shelf computer software that is purchased for

Q85: Which of the following is not a

Q101: Jeremy has $18,000 of Section 1231 gains

Q103: A corporation pays AMT in the current