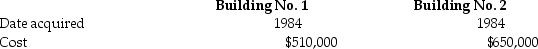

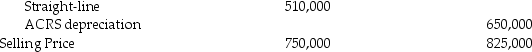

An unincorporated business sold two warehouses during the current year.The straight-line depreciation method was used for Building No.1 and the accelerated method (ACRS)was used for Building No.2.Information about those buildings is presented below.

Accum.Depreciation

Accum.Depreciation

How much gain from these sales should be reported as section 1231 gain and ordinary income due to depreciation recapture?

How much gain from these sales should be reported as section 1231 gain and ordinary income due to depreciation recapture?

Definitions:

John Wesley Powell

An American explorer, geologist, and ethnologist, known for his pioneering expeditions down the Green and Colorado Rivers and his advocacy for conservation and responsible development of the American West.

Interstate Commerce Commission

A regulatory agency in the United States created to oversee the railroads and later expanded to other modes of transportation, aiming to ensure fair rates and practices.

Historical Significance

Describes the importance or impact that an event, person, or place has had on history.

Q45: The terms "progressive tax" and "flat tax"

Q53: Bob owns a warehouse that is used

Q54: Individuals Julie and Brandon form JB Corporation.Julie

Q58: The $250,000/$500,000 exclusion for gain on the

Q63: A manufacturing corporation is owned equally by

Q68: Malea sold a machine for $140,000.The machine

Q71: For tax purposes,"market" for purposes of applying

Q74: All of the following statements are true

Q92: Fariq purchases and places in service in

Q112: Marta purchased residential rental property for $600,000