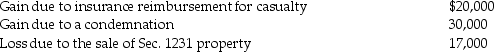

The following are gains and losses recognized in 2016 on Ann's business assets that were held for more than one year.The assets qualify as Sec.1231 property.

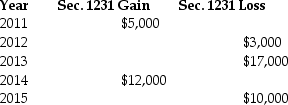

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

Describe the specific tax treatment of each of the current year transactions.

Describe the specific tax treatment of each of the current year transactions.

Definitions:

F-statistic

A ratio used in statistical analysis to determine the significance of a group of variables in a regression model.

F-to-enter

A criterion used in statistical analysis to decide when a variable should be added to a regression model based on the F-statistic value.

Multiple Regression Analysis

A statistical strategy that employs a selection of explanatory variables to predict the outcome of a variable of interest.

Stepwise Regression

A method of regression analysis in which the selection of predictive variables is carried out by an automatic procedure.

Q2: What is an important aspect of a

Q20: The holding period of like-kind property received

Q21: Eric exchanges a printing press with an

Q24: A corporation is starting to produce watches

Q40: Xerxes Manufacturing,in its first year of operations,produces

Q44: Which of the following statements with respect

Q55: Expenditures that enlarge a building,any elevator or

Q59: AB Partnership earns $500,000 in the current

Q76: With respect to residential rental property<br>A)80% or

Q139: In the current year,Bosc Corporation has taxable