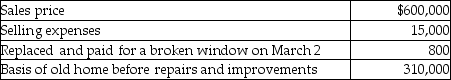

Pierce,a single person age 60,sold his home this year.He had lived in the house for 10 years.He signed a contract on March 4 to sell his home.  Based on these facts,what is the amount of his recognized gain?

Based on these facts,what is the amount of his recognized gain?

Definitions:

Plan Asset Value

The market value of assets that are held within a pension or retirement plan.

Discount Rate

The interest rate used in discounted cash flow analysis to determine the present value of future cash flows or in determining the interest rate charged to financial institutions for loans from the Federal Reserve.

Pension Plans

Financial programs established by employers to provide retirement income to employees.

Current Accounting Standards

The latest guidelines and principles established by regulatory bodies for the preparation and presentation of financial statements.

Q3: Well-being and health are the same concept.

Q32: The adoption credit based on qualified adoption

Q38: Does Title 26 contain statutory provisions dealing

Q49: Helen,who is single,is considering purchasing a residence

Q80: Blair,whose tax rate is 28%,sells one tract

Q83: Galaxy Corporation purchases specialty software from a

Q91: Ilene owns an unincorporated manufacturing business.In 2016,she

Q91: Under the cash method of accounting,all expenses

Q92: The largest source of federal revenues is

Q100: Which of the following taxes is progressive?<br>A)sales