Everest Corp.acquires a machine (seven-year property)on January 10,2016 at a cost of $2,022,000.Everest makes the election to expense the maximum amount under Sec.179.

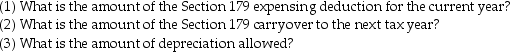

a.Assume that the taxable income from trade or business is $1,500,000.

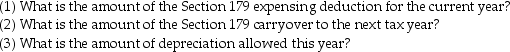

b.Assume instead that the taxable income from trade or business is $400,000.

b.Assume instead that the taxable income from trade or business is $400,000.

Definitions:

Surplus II

An excess of production or supply over demand, leading to potential wastage or decrease in prices.

Total Surplus

The total benefits society gains, encompassed by the addition of consumer surplus and producer surplus within a market.

Consumer Surplus

The variation between the sum consumers are willing to allocate for a good or service and the sum they actually allocate.

Surplus II

An additional amount of a resource, product, or service that exceeds the amount demanded or utilized.

Q1: David Resnik holds that research funding as

Q2: What is an important aspect of a

Q2: According to Mary Ann Warren, which of

Q6: Who developed the example of the drowning

Q9: Many disagreements over global health issues involve

Q12: The U.S. spends more on health care

Q22: Jillian,a single individual,earns $230,000 in 2016 through

Q35: A taxpayer sells a parcel of land

Q58: The $250,000/$500,000 exclusion for gain on the

Q100: Summer exchanges an office building used in