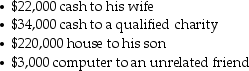

Paul makes the following property transfers in the current year:  The total of Paul's taxable gifts,assuming he does not elect gift splitting with his spouse,subject to the unified transfer tax is

The total of Paul's taxable gifts,assuming he does not elect gift splitting with his spouse,subject to the unified transfer tax is

Definitions:

First Payment

The initial amount paid at the start of a financial agreement or loan.

Compounded Annually

A method of calculating interest where the interest rate is applied once per year, adding to the principal sum for the next period.

Equal Annual Payments

Regular payments of the same amount made over a specified period of time.

First Payment

The initial amount paid at the start of a payment plan or schedule, such as for a loan or lease.

Q3: In 2015 Anika Co.adopted the simplified dollar-value

Q3: One concern that has been raised about

Q7: The oldest form of advance directive is

Q12: According to Kant, if I donate a

Q17: H. Tristram Engelhardt, Jr. argues that<br>A) Life

Q18: Jacqueline dies while owning a building with

Q25: On April 12,2015,Suzanne bought a computer for

Q42: All of the following conditions would encourage

Q72: Contracts for services including accounting,legal and architectural

Q117: Sela sold a machine for $140,000.The machine