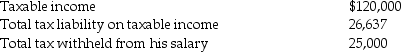

Frederick failed to file his 2016 tax return on a timely basis.In fact,he filed his 2016 income tax return on October 31,2017, (the due date was April 15,2017 and paid the amount due at that time.He failed to make timely extensions.Below are amounts from his 2016 return:

Frederick sent a check for $1,637 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2016.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Frederick sent a check for $1,637 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2016.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Definitions:

Payment

The act of giving money in exchange for goods or services.

EOM

End of Month, a term often used in the context of finance and accounting to denote processes or evaluations performed at the close of the month.

Settle

To resolve or conclude an agreement or debt, often implies paying off a balance owed.

Invoice

A document sent by a seller to a buyer, detailing a transaction and requesting payment.

Q1: Joel Feinberg believes that children have an

Q2: How do work groups organize staff members?<br>A)

Q2: The fact that transplant surgery is expensive

Q9: According to the Congregation for the Doctrine

Q14: Gillian Hanscombe believes that lesbians should not

Q22: According to the "life-cycle principle" a flu

Q47: Jack purchases land which he plans on

Q50: The holding period for boot property received

Q95: A retailing business may use the cash

Q99: A presidential candidate proposes replacing the income