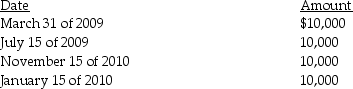

Jack has a basis of $36,000 in his 1,000 shares of Acorn Corporation stock (a capital asset). The stock was acquired three years ago. He receives the following distributions as part of a plan of liquidation of Acorn Corporation:

What are the amount and character of the gain or loss that Jack will recognize during 2009? During 2010?

What are the amount and character of the gain or loss that Jack will recognize during 2009? During 2010?

Definitions:

Income Tax Rate

The portion of an individual's or corporation's income that goes to taxes.

Straight-Line Depreciation

A technique for segmenting the cost of a material asset over its life in even annual segments.

After-Tax Discount Rate

The discount rate used in financial calculations that reflects the net cost of capital after accounting for the effects of taxes.

Discount Factor

A factor by which a future cash flow is multiplied to obtain its present value.

Q11: Research participants<br>A) must be paid if their

Q16: Parent Corporation purchases a machine (a five-year

Q29: A Type C reorganization is a change

Q29: A partial liquidation of a corporation is

Q51: This year, John, Meg, and Karen form

Q52: George pays $10,000 for a 20% interest

Q58: Identify which of the following statements is

Q80: In 2010, Tru Corporation deducted $5,000 of

Q83: Bob exchanges 4000 shares of Beetle Corporation

Q100: Parent Corporation owns 70% of Sam Corporation's